With operations and projects in South Africa, Papua New Guinea and Australia, Harmony is a gold mining specialist with a growing international copper footprint.

FY24 performance

Gold produced

1.56Moz (FY23: 1.47Moz)

Revenue generated

R61.38bn (FY23: R49.28bn)

Production profit

R22.46bn (FY23: R14.41bn)

All-in sustaining cost

R901 550/kg

(US$1 500/oz)

(FY23: R889 766/kg; US$1558/oz)

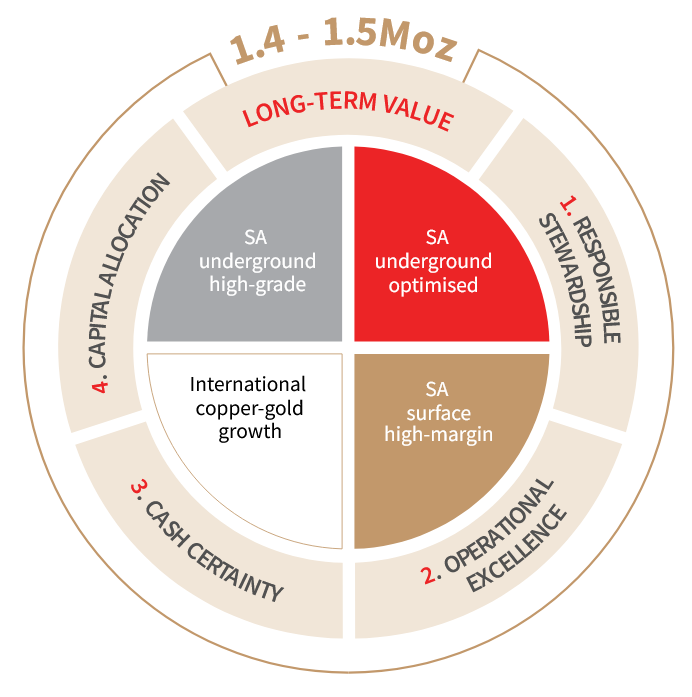

Our strategy

To produce safe profitable ounces and improve margins through operational excellence and value-accretive acquisitions.

Responsible stewardship

Embedding ESG in our business to deliver sustainable business practices – protecting and preserving the environment and creating shared value for our stakeholders.

Operational excellence

Improving the safety, productivity and efficiency of our operations while ensuring we meet annual production guidance and achieve operational plans.

Cash certainty

Maintaining a strong and flexible balance sheet and a net cash position with excellent liquidity.

Effective capital allocation

Evaluating and prioritising safe, organic growth opportunities and value-accretive acquisitions to deliver positive stakeholder returns and increase margins.

WHAT DIFFERENTIATES US

A solid investment case, a compelling gold-copper story

Lower risk

profile

- Prioritising safety

- Embedding ESG

through clear,

sustainable

development strategy - Continuous skills

development - Experienced

management - Strong succession

pipeline

Strong operational metrics

- Operational excellence and good momentum at each mine

- Better efficiencies

through various

business improvement

initiatives - Project execution

discipline - Geared exposure to

Rand/kg gold price

Long, diversified production profile

- Significant gold-copper Resource base

- Excellent Resource to

Reserve conversion

potential - Identifying growth

opportunities that lower

risk and increase

margins - Near-term copper

production - Tier 1 copper-gold

porphyry

Robust and flexible

balance sheet

- Net cash position with excellent liquidity

- Ability to fund capital

and approved projects

internally at current

gold prices - Clear hedging strategy

Clear capital allocation framework

- Balancing growth aspirations with shareholder returns

- Consistent dividends in line with policy