Overview

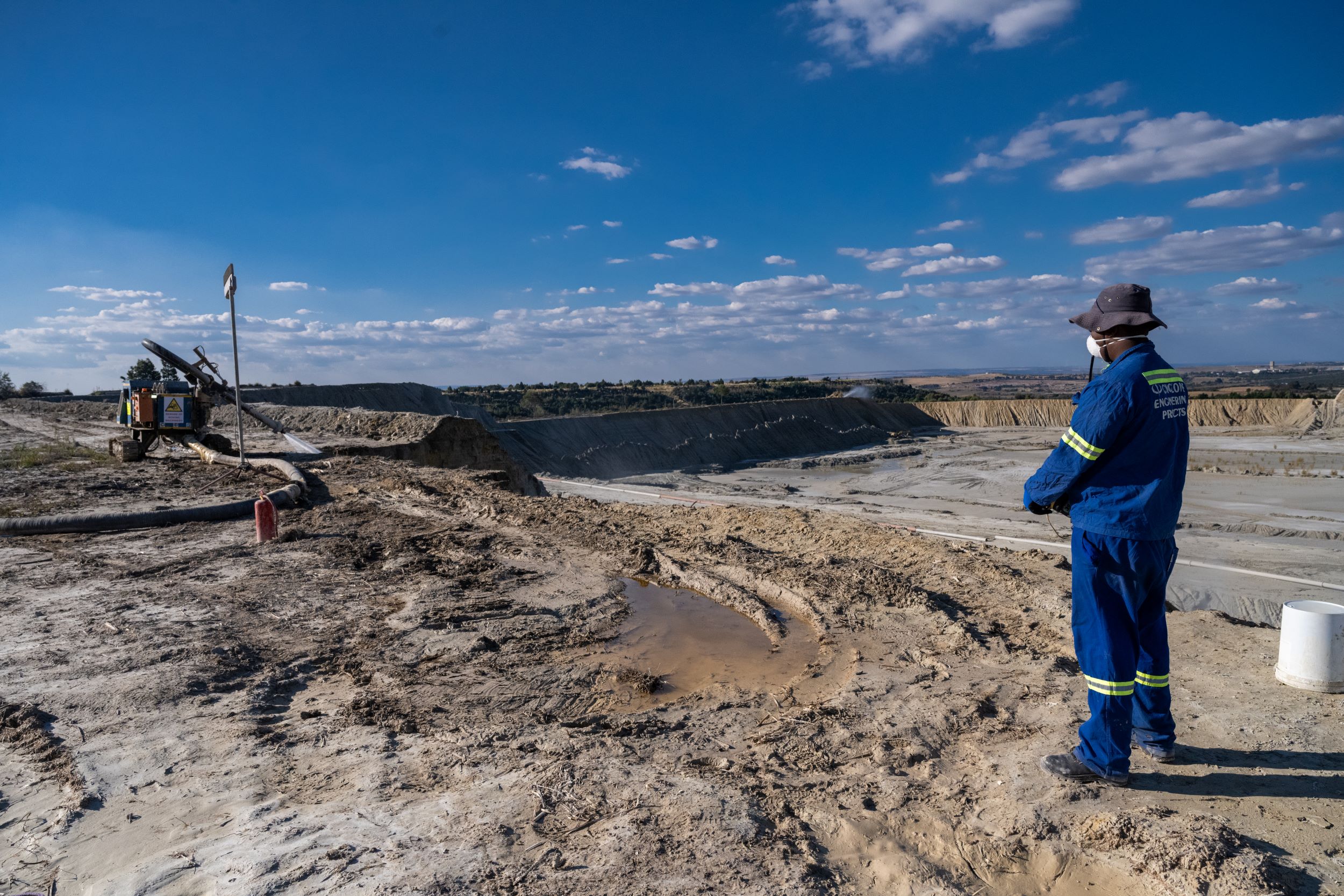

Savuka plant is situated near the town of Carletonville and was acquired from AngloGold Ashanti Limited in October 2020. The plant originally treated both waste rock and tailings but was converted to a tailings treatment facility only in October 2021 when the milling section of the plant was decommissioned.

As at 30 June 2024

- Gold Resource: 0.4Moz

- Gold Reserve: 0.1Moz

- LoM: 3 years

Operating statistics FY24

Production

609kg / 19 579oz

Grade

0.15g/t

Workforce

240

All-in sustaining cost

US$1 027/oz

Operating performance FY24

The operation had a fairly consistent performance year on year with a 3% increase in gold production to 609kg (19 579oz) from 593kg (19 066oz) in the previous year. Volumes of ore processed rose by 4% to 4.02 million tonnes in FY24 from 3.88 million tonnes in FY23. The recovered grade was marginally lower at 0.152g/t (FY23: 0.153g/t).

Gold revenue was higher mainly due to an increase in the average gold price received from R1 038 531/kg to R1 223 769/kg, an 18% rise. Combined with the higher production, revenue was 23% higher at R753 million (FY23: R614 million) for FY24.

The all-in sustaining cost increased by 9% in FY24 to R617 621/kg (FY23: R564 738/kg) mainly due to an 11% increase in cash operating costs. Cash costs increased mainly due to higher cost of chemicals, an increase in MPRDA royalties as well as annual wage and electricity tariff increases. Capital expenditure for FY24 at R21 million was 31% higher than the previous year (FY23: R16 million), mainly for plant maintenance.

Our focus area in FY25

Continue safe operations and deliver operational excellence through a combination of a good health and safety environment, cost competitiveness and improving process efficiencies.